How to Pay a Bill in Australia: A Step-by-Step Guide

Learn how to pay bills in Australia with our step-by-step guide. Covers BPAY, direct debit, online payments, and in-person options for utilities, rent, and services. Ideal for new residents.

By:

PAUL MORREN

Last Updated:

Oct 16, 2024

Tags:

#daily-life #finances

In this article

Paying bills. An unfortunate fact of life around the world, but it can hit especially hard in an expensive country like Australia.

It's especially important to understand all the options on how to pay so that you don't fall behind. Flexible payment options, such as cash, card, and online methods like PayPal, enhance convenience and allow users to select their preferred payment method tailored to their needs, whether for single or recurring transactions.

In this guide, we cover the most common types of bill in Australia, the various payment methods, and some tips on how to handle when you are having difficulties paying.

Lets dive in!

What is a bill?

A bill is simply a request for payment for a service or utility you've used. In Australia, bills can be either pre-paid (where you pay before using the service) or post-paid (where you pay after using the service).

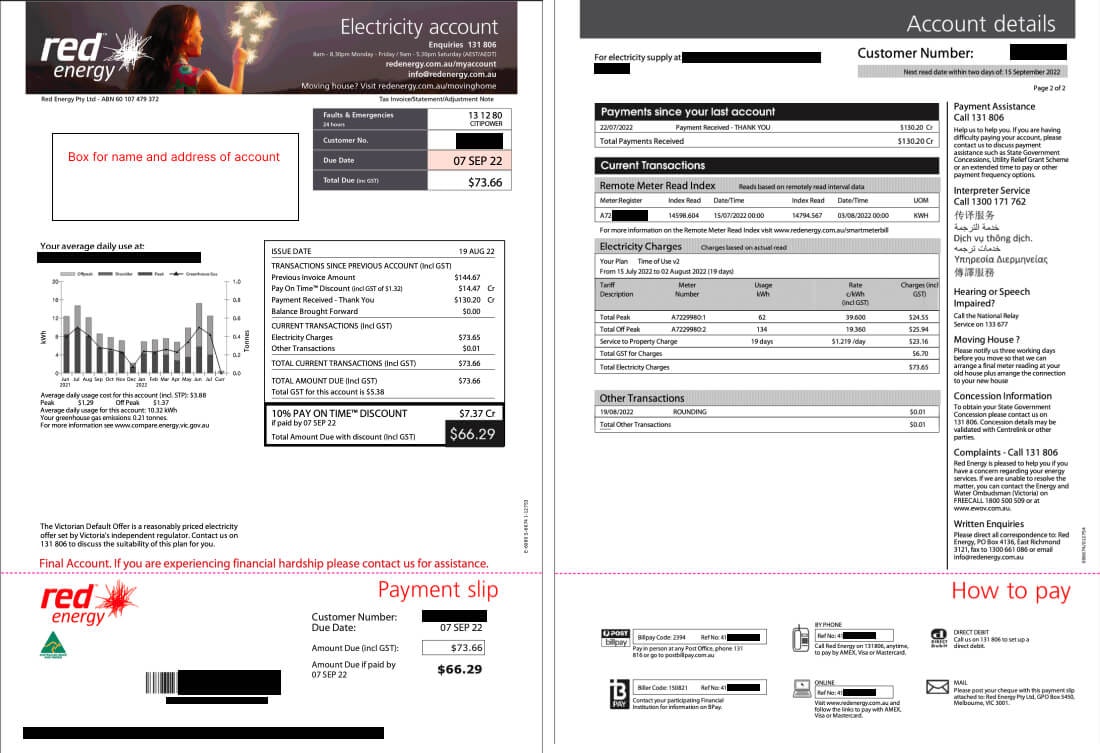

To give you an idea of what to expect, here's what a typical power bill looks like:

Common Types of Bills in Australia

Utilities (electricity, gas, water)

These are probably the most common bills you'll encounter in Australia. If you're in a share house, another tenant might handle these for you. The frequency of these bills can vary depending on the supplier – they might come monthly, every two months, or even quarterly. Most utility bills have two parts: a daily access charge (a flat rate) and a usage-based component.

While most people pay when they receive the bill, some providers offer direct debit options for automatic payments. In almost all cases, utilities are post-paid. Many utility companies provide flexible payment methods, including online payments, direct debits, and in-person payments at certain locations.

Telecommunications (phone, internet)

For mobile phones, your billing will depend on your plan – it could be prepaid or monthly. Internet bills are almost always set up as a direct debit arrangement and are typically prepaid. Some providers offer package deals where you can combine services like internet, mobile, and landline for potential savings.

Debt payments

If you have any loans or credit cards in Australia, these regular payments also fall under the category of bills. This can include personal loans, car loans, student loans, or credit card balances.

These payments are usually set up on a fixed schedule - weekly, fortnightly, or monthly. Most financial institutions offer automatic payment options, which can help you avoid late fees. It's important to keep track of these payments as they can impact your credit score.

Taxes

If you need to pay taxes in Australia, either personally or for a small business, you'll receive a bill for the amount due after submitting your tax return once per year. These are always post-paid and only cover amounts not automatically deducted from your paycheck - many people actually get a refund and not a bill each year!

Rent or Mortgage

This is likely to be your biggest regular expense in Australia. Some real estate agents or banks allow you to choose your payment frequency (weekly, fortnightly, or monthly). Most often, these payments are made via bank transfer, though other methods may be available.

Rent is typically prepaid, with one month's rent usually required in advance. Mortgage payments are made on a pre-agreed schedule.

Insurance Premiums

This category includes auto insurance, home insurance (for homeowners), and contents insurance (for both renters and owners). Insurance is prepaid. While monthly payments are often an option, many insurers offer significant discounts for annual payments. If you're planning to stay in Australia long-term, prepaying annually could save you money.

Subscriptions

While not traditionally considered "bills," it's worth mentioning recurring payments like gym memberships and streaming services (e.g., Netflix).

These almost always require a credit or debit card for monthly charges, though occasionally they might be set up as a direct debit from your bank account. Subscriptions are always prepaid.

Choosing a Payment Method

Choosing the right payment method is crucial when it comes to managing your bills and payments. With various options available, it’s essential to consider your needs and preferences before selecting a payment method. Here are some factors to consider when choosing a payment method:

Convenience: Look for payment methods that offer flexibility and convenience, such as online banking or mobile payments. These methods allow you to pay bills from the comfort of your home or on the go.

Security: Ensure that the payment method you choose is secure and protects your personal and financial information. Methods like BPAY and PayPal Pay are known for their robust security features.

Fees: Check if there are any fees associated with the payment method, such as transaction fees or late payment fees. Some methods, like credit card payments, may incur additional charges.

Payment Frequency: Consider whether you need to make one-off payments or recurring payments. Some methods, like direct debit, are ideal for recurring payments, while others, like BPAY, are suitable for one-off payments.

By considering these factors and options, you can choose a payment method that best suits your needs and ensures your bill payments are managed efficiently.

How to pay bills in Australia

Ok, so you understand the factors in choosing a payment method, but what are the best options?! Keep reading below where we introduce some of the most popular payment methods and explain how to use them.

How to set up recurring payments by Direct Debit

Direct Debit is a super-common method for paying bills in Australia, where vendors bill your card or bank account automatically after invoicing you. It is most common for fixed price commitments like internet or phone plans.

Here's how it works:

When you sign up for the service, you provide your bank or card details to the supplier.

The supplier charges the bill amount automatically on the due date.

The charges continue like this until the service is cancelled.

For metered bills (like utilities), you'll usually receive notice before the charge. It's popular for fixed-price bills like internet or gym memberships, and is usually has no (or very low) fees for use.

Be careful though - failed payments usually result in a warning and a retry before service suspension, but each failure may incur a fee.

Some people prefer not to use Direct Debit for metered bills as the amount can vary and it can come as a surprise when an unexpected amount is charged. However, it's a convenient and popular solution for for set-price services.

How to make BPAY payments

BPAY is probably the most common way to pay your bills like rego, utility bills, and credit card payments, and is preferred by most suppliers. It is essentially a bank transfer that has all of your account details built in.

To use it, you just do the following:

Find the BPAY box at the bottom of the page with the payment instructions - this will contain the biller code and your reference number (see photo).

Log in to your internet banking or bank phone app of your bank and look for the 'Pay a bill' or 'BPAY' option (this will vary by financial institution).

Scan the code or enter the payment details as they appear on your bill. Enter the amount on the bill, and click pay!

BPAY is free to use - no fees are charged on the customer side. The funds normally take around 1-3 days to reach the supplier. Payment will only be approved in the online banking app if you have the funds available, so it wont fail.

How to pay a bill online (Supplier website)

Another way to handle bill payment is to go directly to the suppliers app or website. They will often accept direct payment via credit or debit card payment.

The steps to follow are:

Log on to the relevant supplier website or app. You may need to create an account first, being careful to confirm your address and personal details.

Find the payment section, and confirm your bill amount and due date.

Enter your card details and pay like on any other online store.

These payments will nearly always incur a fee (normally 0.7-3% depending on the card). Unless you need to use a credit card (for the frequent flyer miles, or for cashflow reasons) its probably better to use BPAY or one of the other options.

How to pay a bill in-person at Australia Post

If you don't like doing things online, you can always pay in person at a Post Office or other recognised payment center - it normally says on the invoice what places you can pay.

These centers accept payments through various methods, including cash, debit cards, and credit cards, and one great feature is you can pay for bills for anyone - it doesn't need to be in your name. This is especially handy if for any reason someone to pay on your behalf. Just make sure to take the physical or digital invoice, as there will be a barcode that contains the billpay code that the post office worker will need to accept payment.

Be careful though - the Post Office often has long queues, as they handle many other functions besides processing post billpay payments. Unless you need to pay with cash, or pay multiple bills at once, its almost always faster and easier to pay online via one of the other methods.

How to pay a bill on the phone

Sometimes its possible to ring up the vendor and pay on the phone. We don't recommend this method, as its more risky for security reasons - someone may overhear you giving credit card details over the phone.

If you really want to pay over the phone, and your supplier allows it, then the details will be at the bottom of the invoice.

How to pay with an app

Recently there have been a number of payments apps launched in Australia that can help with paying bills on time or managing cashflow issues.

Sniip

Sniip is an app that lets you pay an bill via BPAY any method you like - including credit cards like American express or international cards. Its great for managing bills and payment due dates - you can set automatic charges on the day before the bill is due, and see all of your upcoming due dates in one place.

Sniip also lets you generate Frequent flyer miles on payments that normally would not be eligible, by using a points generating credit card. If you use a card to pay they add a fee of 0.65-3.00%, but bank transfer payments are fee-free. This app can be a great way to pay bills with a card from home (maybe your parents card!) if you don't mind paying the fee.

Sign up for Sniip on their website.

Zip

Zip is an app that lets you use a short term loan to pay your bills - similar to Afterpay. It can be very useful to smooth out an unexpected large amount, but be careful as they money will need to be repaid in instalments and there are fees of $10 a month while the loan is active.

Find more information about Zip at their website.

Managing your bill payments

Managing your payments effectively is crucial to avoid late fees, penalties, and negative impacts on your credit score. Here are some tips to help you manage your payments:

Set Up Recurring Payments: Consider setting up recurring payments for regular bills, such as utility bills or credit card payments. This ensures that your bills are paid on time without you having to remember each due date.

Use Online Banking: Online banking allows you to manage your payments, view your account details, and set up payment reminders. It’s a convenient way to keep track of your finances and ensure timely payments.

Keep Track of Payment Due Dates: Make sure to keep track of payment due dates to avoid late fees and penalties. You can use a calendar, a financial app, or set reminders on your phone.

Consider a Payment Plan: If you’re struggling to make payments, consider setting up a payment plan with your biller. This can help you manage your payments more effectively and avoid falling behind.

By following these tips, you can manage your payments more efficiently and avoid the stress and financial consequences of missed payments.

Dealing with Payment Difficulties

If you are going to have trouble paying the bill, most service providers prefer to work with you rather than see you get into financial trouble. They often offer payment plans or bill pause services if you're experiencing genuine hardship.

However, these options are sometimes only available to Australian permanent residents. Keep in mind that these are typically last-resort measures. While they can provide temporary relief, they can make it harder to get back on track financially since all bills eventually need to be paid.

Contacting the provider or financial institution

If you're having trouble paying a bill, the first step is to contact your service provider. Their contact details are usually at the bottom of your bill.

However, this process can sometimes be challenging. Many companies outsource their call centers to countries like India, which can mean long waiting times and potential language barriers, especially if English isn't your first language.

A quicker and often more ESL-friendly option, if available, is to use the online chat feature on the provider's website.

Understanding Your Rights as a Consumer

As a consumer in Australia, you have rights protected by the Australian Consumer Law, regardless of your visa status. The Australian Competition and Consumer Commission (ACCC) is a key regulatory body that oversees these rights. You're entitled to clear and accurate bills, timely bill delivery, and detailed information about your usage. You also have privacy rights regarding your personal and financial information.

If you believe there's an error on your bill, you have the right to dispute it. Here's a general process to follow:

Contact your service provider and explain the issue

Provide any evidence you have to support your claim

Ask for a timeframe for resolution

If unsatisfied, you have the right to escalate your complaint

Be aware of unfair billing practices, such as excessive late fees or unclear terms. If you encounter these, you can report them to the relevant authorities.

Protection Against Disconnection

There are rules around disconnection notices in Australia. Providers must give you adequate notice before disconnecting a service. There are also special protections for vulnerable consumers, such as those with medical conditions requiring continuous service.

If you can't resolve an issue directly with your service provider, there are other avenues for help:

Use the provider's internal dispute resolution process

Contact the relevant industry ombudsman (e.g., Telecommunications Industry Ombudsman, Energy and Water Ombudsman)

Reach out to your state or territory's consumer protection agency

Remember, it's always better to address payment difficulties early. Most service providers are willing to work with you to find a solution, especially if you're proactive about the situation.

Switching providers

In Australia, you have the right to choose and switch service providers for most utilities and services. This competition among providers often results in better deals and service quality for consumers, and for services like mobile phones or insurance can mean big savings.

Before you switch, remember to consider the following points:

Contract terms: Check if you're still under contract with your current provider. Breaking a contract early might incur fees.

Exit fees: Some providers charge exit fees. Factor these into your decision when comparing offers.

Connection fees: Your new provider might charge a connection or setup fee.

Service comparison: Compare not just prices, but also service quality, customer support, and additional features.

Timing: Plan your switch to avoid service interruptions, especially for essential utilities.

Remember, your new provider should handle most of the switching process, including contacting your old provider to cancel the service.

Frequently asked questions

What happens if I don't pay the bill?

Failing to pay a bill can result in late fees, service disconnection, and potential damage to your credit score, so it's crucial to contact your provider immediately if you're having payment difficulties.

How do I know my payment has gone through?

Most of the payment methods will give you a receipt or confirmation number. If the provider tells you that you've missed the payment but you think its paid, its best to check your bank statement and then contact the provider if needed.

I moved out of a share house, but the bills are still in my name. What should I do?

Contact each service provider immediately to either cancel the service or transfer it to another name, and provide your new address for any final bills. If the new tenants don't pay on time, it can affect your credit rating and you will be liable for the debt.

I accidentally overpaid, what can I do?

If you've overpaid, the provider will typically either refund the overpayment or credit it to your next bill.

Conclusion

Navigating the world of bill payments in Australia might seem daunting at first, especially for newcomers, but with a bit of knowledge and organisation, it becomes a manageable part of daily life.

By understanding your bills, knowing your payment options, and staying on top of due dates, you'll avoid unnecessary stress and fees. And who knows? You might even find ways to save money along the way.

Good luck!